The U.S. economy is currently navigating through a complex landscape marked by recession concerns, primarily fueled by the ongoing trade war’s impact and a dwindling consumer sentiment index. Recent heavy losses in U.S. markets underscore fears that heightened tariff policy effects could lead to an economic slowdown, pushing the nation closer to a recession. With the Federal Reserve contemplating interest rate adjustments, the balance between stimulating growth and managing inflation becomes exceedingly delicate. Analysts warn that prolonged uncertainty from recent governmental policies could exacerbate these economic challenges. As a result, American businesses and consumers alike are left questioning the future stability of the economy amidst rising tensions and shifting market dynamics.

Currently, the United States faces significant economic headwinds, suggesting a downturn could be on the horizon. Factors such as the ongoing trade dispute and diminishing consumer confidence highlight the potential for a recession. The ramifications of recent policy decisions regarding tariffs may further escalate the economic slowdown, prompting critical discussions about necessary adjustments to interest rates by the Federal Reserve. As experts analyze the overall financial atmosphere, it becomes evident that the health of the economy hinges on a delicate interplay of global trade relations and domestic fiscal policy. In light of these turbulent conditions, stakeholders are bracing for potential impacts that could redefine economic trajectories in the near future.

The Impact of Trade War on the U.S. Economy

The ongoing trade war has greatly affected the U.S. economy, introducing significant risks of recession. As tariffs are imposed on American goods by countries like China, Mexico, and Canada, the cost of imports rises, and domestic consumer prices may increase, leading to weakened consumer spending. This concern is echoed by analysts and economists alike, signaling that sustained trade hostilities could trigger a downturn. In an environment where the consumer sentiment index has dropped to its lowest since late 2022, individuals may be more reluctant to spend, further aggravating the economic slowdown.

Moreover, trade policies that are creating uncertainty have disrupted the confidence investors typically need to make long-term commitments. The ongoing tit-for-tat tariff policies suggest an unpredictable market, leading many to adopt a defensive posture. When consumers and businesses perceive a high level of risk, they reduce their spending and investment, decreasing economic activity. Economists warn that if this trend continues, the U.S. economy could face a self-fulfilling prophecy of recession, as lower spending leads to lower production and further layoffs.

Federal Reserve Strategies Amid Economic Challenges

In light of the economic uncertainties primarily driven by the trade war and fluctuating consumer confidence, the Federal Reserve is at a crossroads regarding its interest rate policy. Faced with the dual challenge of rising inflation and a potential economic slowdown, the Fed must carefully consider its next steps. Many experts are advocating for a cautious approach, maintaining interest rates to keep inflation in check while also hinting at potential cuts should economic indicators worsen further. This precarious balance is critical as any wrong move may exacerbate current market sentiments.

Additionally, the Fed’s decisions must closely align with emerging economic data, including the consumer sentiment index, which remains a vital signal of economic health. If consumer confidence continues to decline, and the labor market shows signs of cooling, the Fed could find itself under increasing pressure to act. However, an environment of persistent tariff-induced uncertainty may limit the effectiveness of rate cuts, as businesses may remain hesitant to invest, regardless of lower rates. This highlights the complex nature of the Fed’s current dilemma as it navigates through turbulent economic waters.

Consumer Sentiment Index: A Barometer for Recession Risks

The University of Michigan’s consumer sentiment index serves as a crucial indicator of the U.S. economy’s health, reflecting how consumers feel about their financial situations and the overall economy. A decrease in this index often foreshadows reduced spending as consumers tighten their belts in anticipation of tougher economic times. With the index currently at its lowest level since November 2022, there’s growing concern that a significant drop in consumer sentiment could lead directly to decreased economic activity, raising the specter of recession.

As consumer confidence falters amidst ongoing tariff disputes and trade uncertainties, businesses may find themselves caught in a challenging cycle. Lower consumer spending can lead to reduced revenues, which may drive companies to cut back on hiring or capital expenditures. This, in turn, may further depress consumer sentiment, creating a feedback loop that can result in a more pronounced economic slowdown. Analysts are keeping a close watch on this index, as a prolonged period of low confidence could very well signal an approaching recession.

Tariff Policy Effects and Economic Outlook

The effects of current tariff policies can reverberate throughout the economy, significantly impacting both supply chains and consumer prices. Tariffs on imported goods raise costs for consumers and businesses alike, complicating budgeting and forecasting efforts. As companies reassess their strategies in response to higher tariffs, the stability of various sectors may be jeopardized, potentially leading to increased layoffs and reduced market investments. The negative implications of tariff-induced costs can ripple through the economy, ultimately dimming growth prospects.

In this tense environment, businesses are faced with the challenge of adapting to ever-changing tariff regulations. This instability in trade relations not only impairs short-term consumer spending habits but also generates long-term strategic challenges for companies who must balance their supply chains against uncertain import costs. If the situation remains unresolved, U.S. companies may seek to diversify their operations away from tariff-impacted regions, which could itself drive up costs and reduce efficiency. Consequently, the specter of recession looms larger as the economic fabric becomes increasingly frayed under the strain of such policies.

Economic Slowdown: Signs and Implications

An economic slowdown can manifest in various ways, including decreased consumer spending, stagnation in job growth, and declining investment levels. The ongoing trade war, high inflation, and uncertainty surrounding fiscal policy all contribute to a chilling effect on the economy. As confidence wanes, businesses are likely to delay or cancel investments, fearing that a downturn might lead to unanticipated losses. When the economy contracts, this can lead to a cycle of reduced hiring, poor market performance, and ultimately, recession.

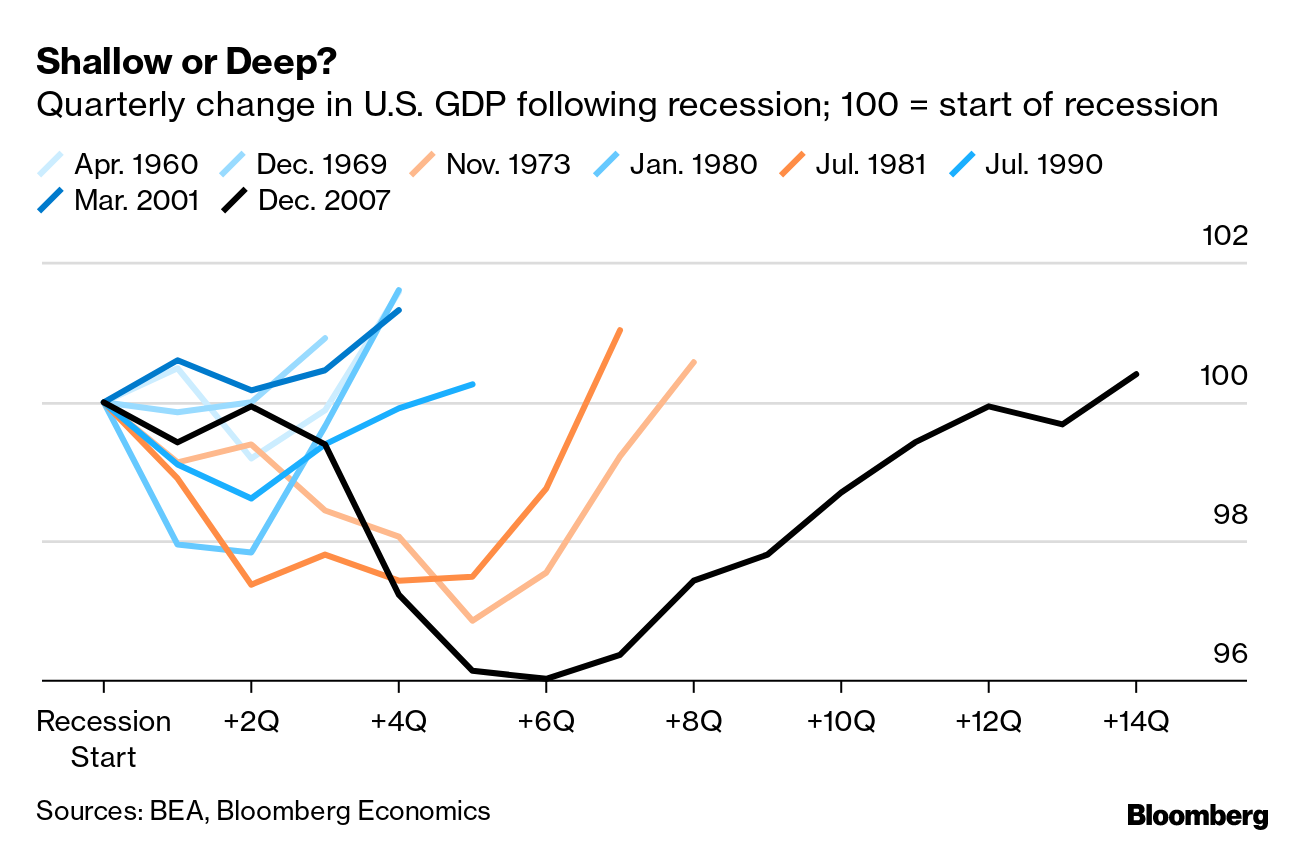

The historical patterns of economic slowdowns often exhibit that the repercussions are not evenly felt across all sectors. While some areas, such as consumer goods, may contract quicker due to reliance on discretionary spending, others might take longer to feel the heat. As hiring cools and consumer confidence dips, wages may stagnate, further reducing spending power. This challenges policymakers and central banks to act carefully yet decisively in order to mitigate the long-term impacts that could stem from a deeper recession.

Anticipating the Federal Reserve’s Interest Rate Moves

The Federal Reserve plays a vital role in shaping economic outcomes through its interest rate policies. Currently facing a complicated landscape defined by high inflation rates and potential economic slowdown, the Fed must decide whether to pursue rate cuts to stimulate growth or to maintain the status quo to fight inflationary pressures. This conundrum is exacerbated by an increasing perception of risk associated with tariff policies and the broader implications of a trade war, which can instabilize the financial market.

Historically, interest rate cuts have been used to encourage borrowing and investment, thereby spurring economic growth. However, in an environment teetering on the edge of recession, the effectiveness of such measures can be diluted. If consumer and business confidence remains low, even the most attractive borrowing rates may fail to inspire significant economic activity. Thus, the Fed’s ongoing analysis of economic indicators must remain nuanced, weighing the potential consequences of each decision against the backdrop of global trade tensions and domestic sentiment.

The Interplay Between Fiscal Policy and Economic Sentiment

Fiscal policy plays a crucial role in shaping economic sentiment and, by extension, consumer behavior. When the government issues large deficits or behaves unpredictably in trade matters, it can lead to adverse reactions from both consumers and investors. As the public perceives risks involving tax policies, spending cuts, or federal support, confidence may dwindle, pushing the economy toward stagnation. The potential for a fiscal crisis, such as a government shutdown or failure to raise the debt ceiling, only adds fuel to the fire of uncertainty.

In this environment, the relationship between fiscal actions and public sentiment becomes intricately linked. Policymakers must steer clear of decisions that could further erode confidence or lead to a sudden economic correction. Restoring stability and predictability is essential for cultivating an environment conducive to growth. As Americans witness unpredictable shifts in government policy, the overall economic sentiment is at risk, making coordinated and clear fiscal strategies imperative to avoiding a recession.

Seasonal Economic Indicators and Long-Term Predictions

Seasonal economic indicators act as critical tools in forecasting economic health and trends. Understanding these patterns often allows economists and policymakers to anticipate shifts in consumer behavior and market conditions. For example, seasonal spikes in retail spending around holidays can be offset by their decline in subsequent months, providing a clearer picture of underlying trends. With current trends indicating potential economic weakness, identifying and interpreting these fluctuations becomes all the more important.

Long-term predictions often necessitate integrating various data points, including tariff impacts, interest rates, and consumer sentiment. By considering a comprehensive view of these indicators, economists can better inform predictions about future economic conditions. If recent trends towards an economic slowdown persist, the risks of entering a recession may increase, warranting proactive measures by stakeholders. Accurate prediction and timely intervention can reduce the economic fallout, maximizing the chances for recovery and growth.

The Role of Consumer Spending in Economic Resilience

Consumer spending remains the backbone of the U.S. economy and is often viewed as a key indicator of economic health. In times of uncertainty, such as during a trade war or economic slowdown, consumer responses can denote broader market trends. When individuals feel less secure about their financial futures, they tend to curtail discretionary spending, which can dampen overall economic growth. Understanding the delicate balance of consumer sentiment and spending is crucial for policymakers aiming to stave off recession.

Furthermore, a resilient economy often hinges on the capacity of consumer spending to withstand external shocks, such as tariffs or abrupt policy changes. As consumer confidence fluctuates, so too does the potential for sustained economic growth. If strategic measures can be employed to enhance consumer confidence, such as providing clarity in fiscal policy or reassuring economic stability, the potential for robust consumer spending can rebound. This is paramount to navigating the challenges posed by trade wars or economic downturns.

Frequently Asked Questions

How are tariffs affecting the U.S. economy recession risk?

Tariffs can exacerbate the U.S. economy recession risk by increasing trade tensions and costs for domestic producers. The recent trade war has resulted in retaliatory tariffs from countries like China, Mexico, and Canada, which may lead to higher consumer prices and reduced economic activity, contributing to fears of a recession.

What is the Federal Reserve’s role in managing the U.S. economy recession?

The Federal Reserve plays a critical role in managing the U.S. economy recession by adjusting interest rates. During times of economic slowdown, the Fed may consider cutting rates to stimulate spending and investment. However, they also must balance this against inflationary pressures that can arise from increased borrowing.

How does consumer sentiment index reflect the U.S. economy recession?

The consumer sentiment index is a key indicator of public confidence in the economy. A declining index, such as the one recently observed, suggests that consumers are worried about their financial situations, which can reduce spending and exacerbate conditions that lead to a U.S. economy recession.

What are the potential tariff policy effects on U.S. economic growth?

Tariff policy effects can hinder U.S. economic growth by disrupting trade relationships, increasing costs for consumers and businesses, and creating uncertainty in markets. This environment can reduce investment and consumption, increasing the likelihood of an economic slowdown or recession.

Can the U.S. economy avoid a recession amid increasing trade war tensions?

Avoiding a recession amid increasing trade war tensions is challenging, as these tensions can weaken economic fundamentals. However, if the Federal Reserve successfully manages interest rates and policy measures address consumer and business confidence, it may mitigate recession risks.

How do changes in Federal Reserve interest rates affect the U.S. economy during a recession?

Changes in Federal Reserve interest rates can significantly influence the U.S. economy during a recession. Lowering rates makes borrowing cheaper, encouraging spending and investment, while raising rates can help control inflation. The Fed’s decisions directly impact economic activity and recovery potential.

What signs indicate a possible U.S. economy recession?

Signs indicating a possible U.S. economy recession include a falling consumer sentiment index, declining stock market values, job cuts, and ongoing trade tensions. Increased perceptions of risk and uncertainty in monetary policy also contribute to recession fears.

What is the impact of economic slowdown on employment rates in the U.S.?

An economic slowdown typically leads to rising unemployment rates as businesses may reduce hiring or lay off workers in response to decreased demand and uncertain market conditions. This negative feedback loop can prolong and deepen a recession.

How are businesses responding to fears of a U.S. economy recession?

Many businesses are adopting a ‘wait and see’ approach in response to fears of a U.S. economy recession, reducing investment and spending. Uncertainty surrounding trade policies and potential consumer behavior can drive companies to hesitate in expanding operations or workforce.

| Key Point | Details |

|---|---|

| Recession Warnings | Concerns arise from trade wars, heavy market losses, and low consumer sentiment. |

| Impact of Tariffs | Economist Jeffrey Frankel argues tariffs are generally harmful and may hurt investment and growth. |

| Current Economic Indicators | Consumer sentiment is at its lowest since November 2022, with hiring slowing down. |

| Risks of Recession | Five main factors include trade wars, stock market instability, government spending cuts, fiscal crisis, and rising risk perception. |

| Federal Reserve’s Dilemma | The Fed must balance supporting the economy with interest rate cuts against controlling inflation. |

Summary

The U.S. economy recession is a pressing concern as various indicators highlight potential downturns. Recent trade wars have contributed to market instability, while consumer sentiment has significantly declined. Given the complexities surrounding tariffs and the Federal Reserve’s challenges in navigating inflation and growth, the possibility of a recession looms larger than previously anticipated. Investors and policymakers alike must remain vigilant as the economic landscape continues to evolve.